Atypical Enrollment Checklist

Last revised 1/29/2026

See a complete list of provider types on the Find Your Provider Type web page.

Note: This checklist is for Atypical providers that are NOT Home and Community-Based Services (HCBS) providers. HCBS (waiver) providers may visit the Enrollment Type web page for different instructions.

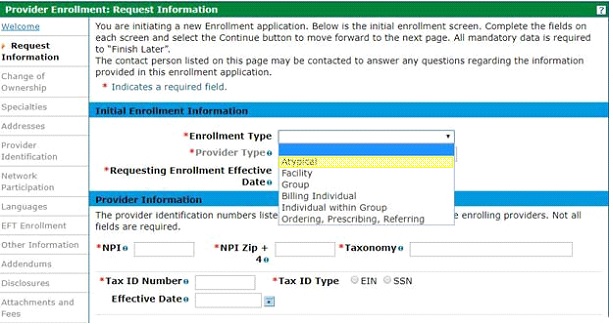

Request Information Page

☑ Enrollment Type

- Select the Atypical enrollment type from the dropdown.

- Note: Individual/Social Security Number (SSN) enrollments are limited to one enrollment only.

☑ Provider Type

- See a complete list of provider types on the Find Your Provider Type web page.

☑ Requesting Enrollment Effective Date

- A future enrollment effective date is not allowed. A backdate (up to ten months) can be requested; however, the request is not a guarantee of approval. See the Backdate Enrollment Quick Guide.

☑ National Provider Identifier (NPI) (if applicable)

- To determine if an NPI is required, reference the requirements for each provider type on the Find Your Provider Type web page.

- Don’t have an NPI and need one? One can be obtained from the National Plan & Provider Enumeration System website.

- When using an NPI, enter the organizational (Type-2) or individual (Type 1) NPI & zip code + 4, as applicable. The application will be returned for correction if the incorrect NPI is used.

☑ Taxonomy Code

- A taxonomy code is only needed if an NPI is required. If an NPI is not needed, do not include taxonomy codes in the application.

- A complete Health Care Provider Taxonomy Code Set can be found on the National Uniform Claim Committee website.

- At least one of the taxonomy codes included in the application must match at least one of the taxonomy codes associated to the NPI in the National Plan & Provider Enumeration System (NPPES).

- The NPPES NPI Registry lookup can be used to see the taxonomy codes that are currently associated with the NPI.

☑ Tax ID Number

- Some Atypical provider types require an organization to enter an EIN, some require an individual to submit an SSN, some may use either. Please check the Tax ID requirements for the service(s) being provided on the Find Your Provider Type web page.

- Enter the Federal Employer Identification Number (EIN) or Social Security Number (SSN) as applicable and select the corresponding Tax ID Type.

☑ Contact Information

- This Contact email address will receive notifications regarding the status of the application.

Specialties Page

☑ Specialty

- Select the appropriate specialty from the dropdown.

- There are many instances where the only specialty option is the provider type chosen. If this is the case, select the only option available.

☑ Taxonomies (if applicable)

- Do not add taxonomy codes if an NPI is not provided.

Addresses Page

☑ Service Location Address Information (including zip code + 4)

- Each service location requires a separate application for business (FEIN) enrollments. Individuals (SSN) enrollments are limited to one enrollment only.

- Service location must be a physical address and cannot be a PO Box.

- Including the 9-digit (zip code + 4) service location zip code is crucial for claims payment. Don’t know the 9-digit zip code? Look it up on the USPS website.

☑ Billing Address Information (including zip code + 4)

- A "Pay to Name" is required; e.g., Office Manager, Billing Manager.

- One of the addresses (service location, billing or mailing) must match the address on the W-9.

☑ Mailing Address Information

- A "Mail to Name" is required (e.g., Attn: Front Desk, mail room)

Provider Identification Page

☑ Provider Legal Name

- The "Provider Legal Name" field currently only allows 50 characters, and "Doing Business As" allows 30 (including spaces). Please truncate Legal and DBA names, if necessary.

- Individuals (SSN enrollment) enter their full name – E.g., First Middle Last, First M. Last.

- The "Doing Business As" is optional. If a DBA is used, please enter it exactly as registered.

☑ Organization Structure

- This should match the federal tax classification indicated on the W-9.

☑ Payer

- Select the Title XIX Payer option. (Applicable Payer checkboxes will be enabled and at least one Payer must be selected. Medicaid is Title XIX Payer, Colorado BHA is the Colorado Department of Human Services, Behavioral Health Administration.)

☑ License Information (if applicable)

- Issuing authority, license #, effective date, expiration date, issuing state, and type are required.

- Be sure to enter the entire license number including alpha and numerical characters as well as dots, dashes, etc.

- Don’t forget to attach a copy of the license on the Attachment and Fees page of the application.

☑ Certification Information (if applicable)

- Specialty, certification type, effective date, end date, certification #.

- If the certification does not have an end date, use 12/31/2299. If there is no certification number, enter "N/A".

☑ Medicare Number (if applicable)

- The Effective Date for the Medicare number and the Medicare Type is needed.

- The information included in the application should match what was submitted to Medicare.

Network Participation Page

☑ MCO/RAE Network;

- Complete if participating in any of Colorado Medicaid’s Managed Care Organizations (MCO) or Regional Accountable Entities (RAE).

Languages and Primary Employer/Owner Page

☑ All languages that are able to be translated (if applicable)

EFT Enrollment Page

☑ Federal Agency Information (if applicable)

- Federal Program Agency name, identifier, and location code.

☑ Financial Institution Information (this is required)

- Financial Institution name, ABA routing number, type of account (checking/savings), account number, and the EIN or NPI.

- Have a copy of a W-9 and a bank letter or voided preprinted check, to attach later in the application. The W-9 and bank letter must be dated within the last 6 months and match one of the addresses previously entered (service location, billing and/or mailing).

- Note: EFT is required for all applications except for Out-of-State providers, and Colorado State Government Entities. If qualified for an EFT exemption and not wanting to provide EFT information, please follow these EFT Exemption Instructions.

Other Information Page

☑ Insurance Information

- Carrier name, policy ID, insurance type, effective date, and expiration date.

☑ Supplemental Questions – Medicaid Participation

- Please read each question carefully and answer yes or no as applicable. Enter the applicable states when indicated.

<☑ Additional Information

☑ Additional Provider Search Options (optional)

Addendums Page

☑ Any applicable addendums will be listed here.

Disclosures Page

☑ Disclosure Information

- Health First Colorado cannot advise providers on how to determine owner data and controlling interest requirements, but can provide the following resources:

- Disclosure Completion Instructions for Enrollment using a Federal Employer Identification Number (EIN) (located under “Provider Enrollment and Update Forms".

- Disclosure Completion definitions and Instructions for Enrollment using a Social Security Number (SSN) (located under “Provider Enrollment and Update Forms”.)

- Please note the applicant is the “disclosing entity” for these questions.

Attachment and Fees Page

Scan and attach:

☑ Certifications and licenses (if applicable)

- Please see the Find Your Provider Type web page for a list of requirements based on provider type.

☑ W-9 (signed and dated within the past 6 months)

- If applying using the SSN for the Tax ID, the W-9 should also use the SSN.

- If applying using an EIN for the Tax ID, the W-9 should also use the EIN.

☑ Voided check or bank letter (bank letter signed and dated within the past 6 months)

- Voided checks must be preprinted; temporary checks are not accepted. The imprinted name on the check or bank letter needs to match the legal or DBA name.

☑ For application fee payment (if applicable):

- Please see the Find Your Provider Type web page for a list of requirements based on provider type to determine if an application fee is required.

- Either a credit card number or EFT account information is needed.

- Application fee can only be paid online (via the Attachments and Fees page of the application).

- Credit card payment-processing fee is an additional 2.95%; EFT payment-processing fee is $2.50.

☑ Proof of payment

- If the application fee for another state’s Medicaid program, for this service location, has already been paid.

☑ Hardship waiver request letter and supporting documentation (if applicable)

- Recommended supporting documentation includes most recent entity tax return(s), financial profit/loss exports (i.e., QuickBooks, Xero, etc.), three or more bank statements, and any additional documentation that would validate the hardship(s) indicated within the hardship letter.

- Additional supporting documentation may include but is not limited to historical cost reports, recent financial reports such as balance sheets and income statements, cash flow statements, liability obligations, tax returns, etc.

Agreement

☑ The terms of enrollment are identified in the Provider Participation Agreement which must be read, agreed to, and accepted for enrollment.

- If multiple payers were selected, multiple agreements must be read, agreed to, and accepted.

Summary

☑ Review all data entered in the enrollment application, make additional changes if needed and print a file copy of the application.