Read the Remittance Advice (RA)

Remittance Advice (RA) Sections and Page Numbering

The downloadable PDF RA file does not include every page that is included in the printable RA.

Address Cover Page (Page 1): The Address Cover Page never appears in the PDF file since it is used when mailing an RA.

Banner Message Section (Page 2): Important messages from the Department of Health Care Policy & Financing (the Department) appear on page 2.

Payment Notice Section: The Payment Notice section never appears in the PDF file since it is used for printing a physical check or Electronic Fund Transfer (EFT) notice when mailing an RA.

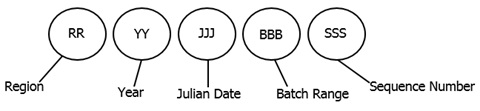

Interpreting Claim Numbers

Every claim and adjustment are assigned a unique claim number known as the Internal Control Number (ICN). The following diagram and table provide detailed information about interpreting the claim number.

| Type of Number and Description | Applicable Number and Description |

|---|---|

| Region - The first two (2) digits indicate how Health First Colorado (Colorado’s Medicaid program) received the claim or adjustment request. | 10 - Paper Claims with No Attachments 50 – Provider-Initiated Adjustment (via paper) 57 - Cash Void 67 - Cash Adjustments |

| Year - Two (2) digits indicate the year the claim was received. | Example: The year 2024 would appear as 24. |

| Julian Date - Three (3) digits indicate the day of the year, by Julian date, that the claim was received. | Example: February 3 would appear as 034. |

| Batch Range - Three (3) digits indicate the batch range assigned to the claim. | The batch range is used internally by Health First Colorado and is not applicable to providers. |

| Sequence Number - Three (3) digits indicate the sequence number assigned within the batch range. | The sequence number is used internally by Health First Colorado and is not applicable to providers. |

Adjustments and Recoupments

Providers will see a Claim Adjustments section in the Remittance Advice (RA) if any claims were adjusted during the current financial cycle.

- Adjustments may be provider-initiated or system-generated. Refer to the region codes above.

- Recoupments are generally done on the same RA as the adjusted claim.

- Exception: The provider does not have enough paid claims to satisfy the recoupments. The recoupment will continue to the following weeks' RAs until the total amount is recouped if the recoupment amount exceeds the paid claim amount.

- Claim information appears in the adjustment section for each claim type.

- Additional payment or overpayment to be withheld is listed for each adjustment.

- Refund Amount Applied

- Refund Amount Reversed

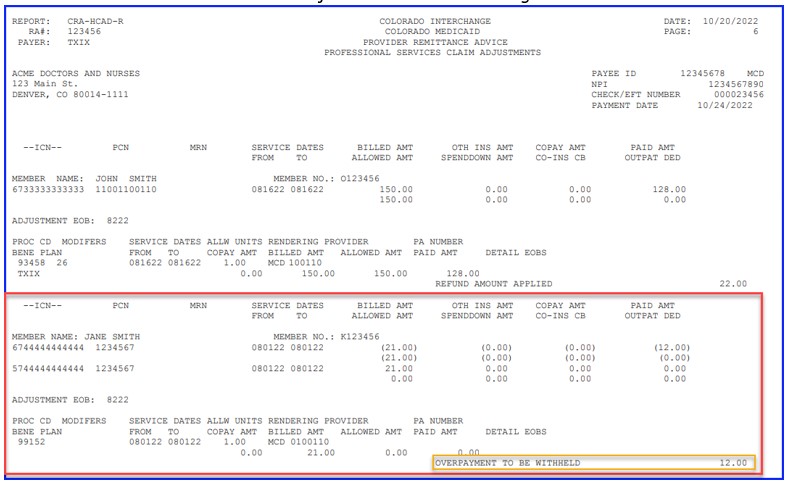

- Refer to Figure 2 to review the amounts and descriptions that may also display simultaneously with Overpayment to be Withheld

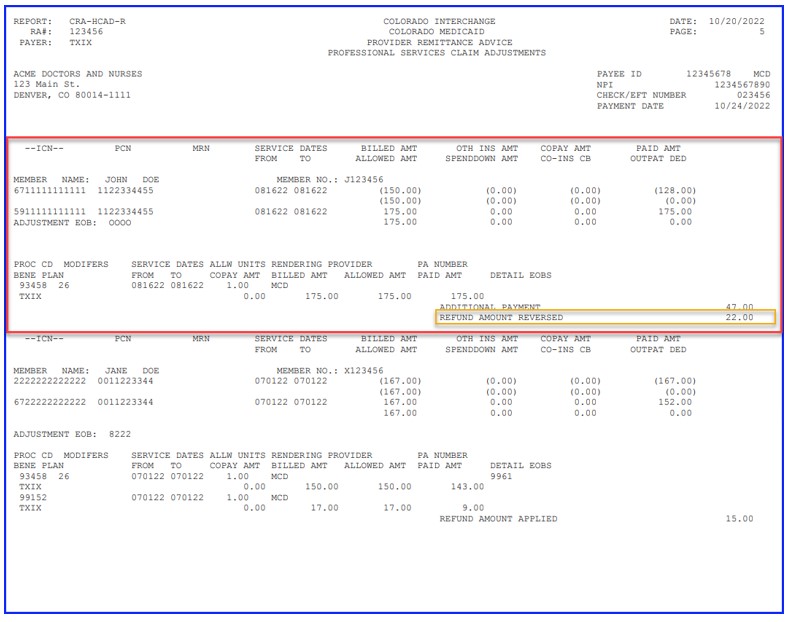

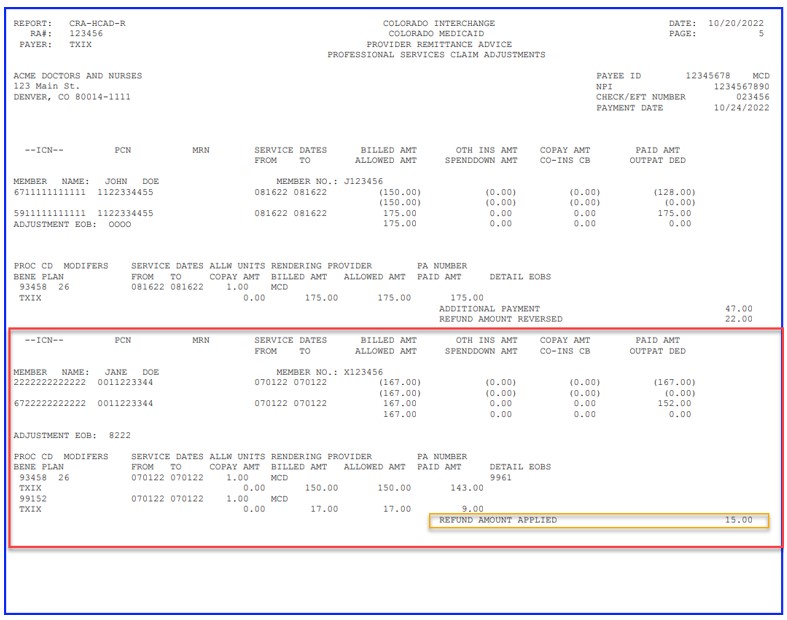

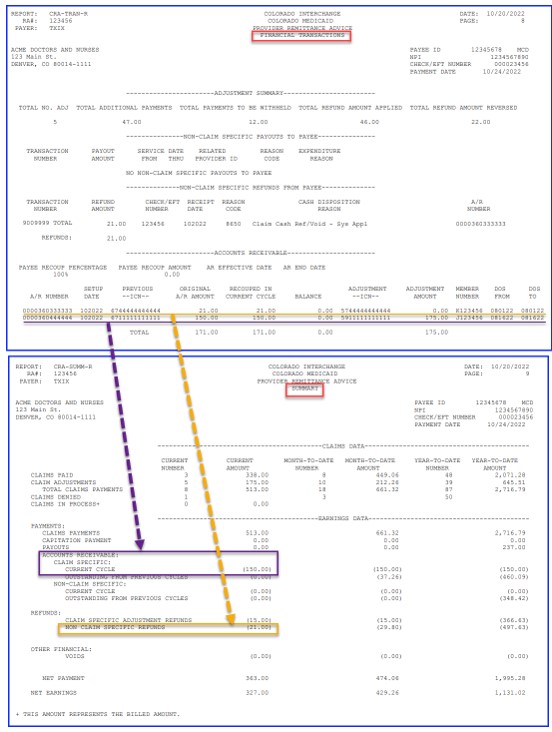

See the Claim Adjustment section in the figure below.

Figure 1 . RA Claim Adjustment - Recoupment

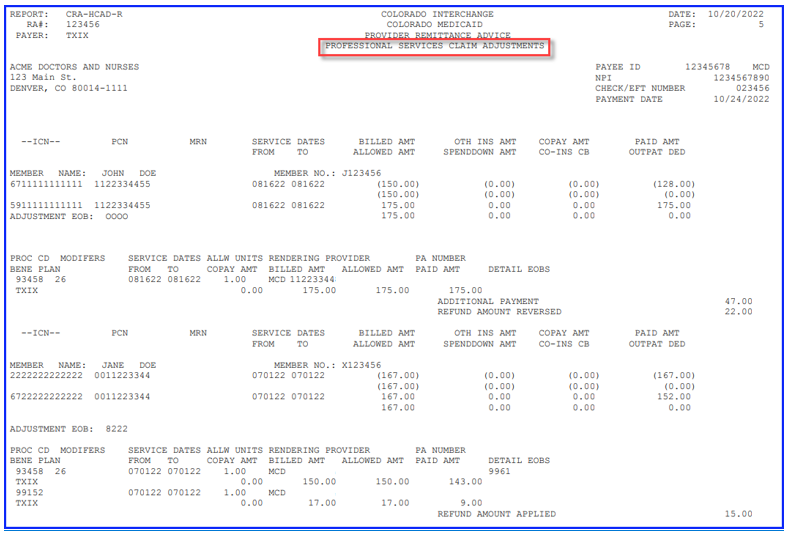

See the Claim Adjustment section in the figure below.

Figure 2. RA Claim Adjustment - Overpayment to be Withheld

Figure 2.1 RA Claim Adjustment - Refund Amount Applied

Figure 2.2 RA Claim Adjustment - Refund Amount Reversed

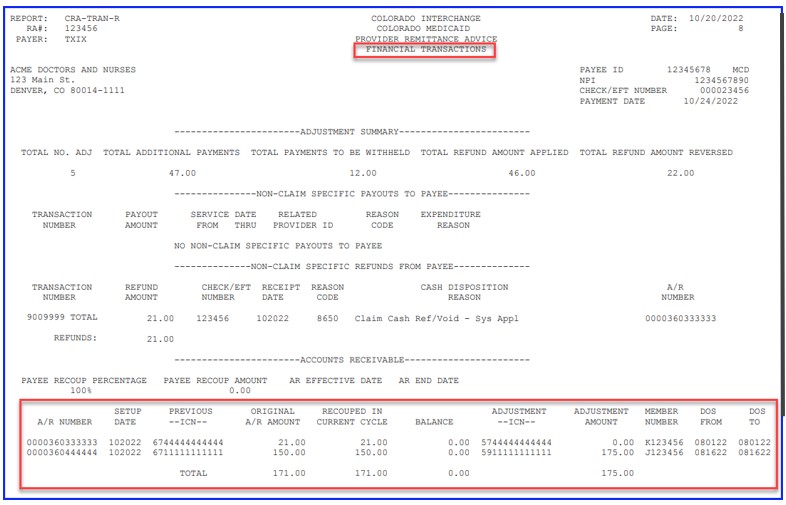

Financial Transactions Page

Adjustment Summary:

- Total No. Adj - The total number of adjusted claims on the RA.

- Total Additional Payments - Additional amount owed to the provider as a result of claim adjustments.

- Total Payment to be Withheld - Additional amount owed by the provider as a result of claim adjustments.

- Total Refund Amount Applied - Amount of the cash receipt received from the provider applied to cash-related claim adjustments.

- Total Refund Amount Reversed - Reversal of cash previously applied to the adjusted claim.

Non-Claim Specific Payouts to Payee section:

- Transaction Number

- Payout Amount

- Service From and Date Thru

- Related Provider ID

- Reason Code - A four (4)-digit code used to identify the Expenditure Reason.

- Expenditure Reason - The reason an expenditure (check/payment) is generated. Refer to Appendix S for the list of Expenditure Reason Codes and their descriptions.

- Total Payouts

Non-Claim Specific Refunds from Payee section:

- Transaction Number

- Refund Amount

- Check/EFT Number

- Receipt Date

- Reason Code - A four (4)-digit code used to identify the Cash Disposition Reason.

- Cash Disposition Reason - The reason for the Cash Disposition.

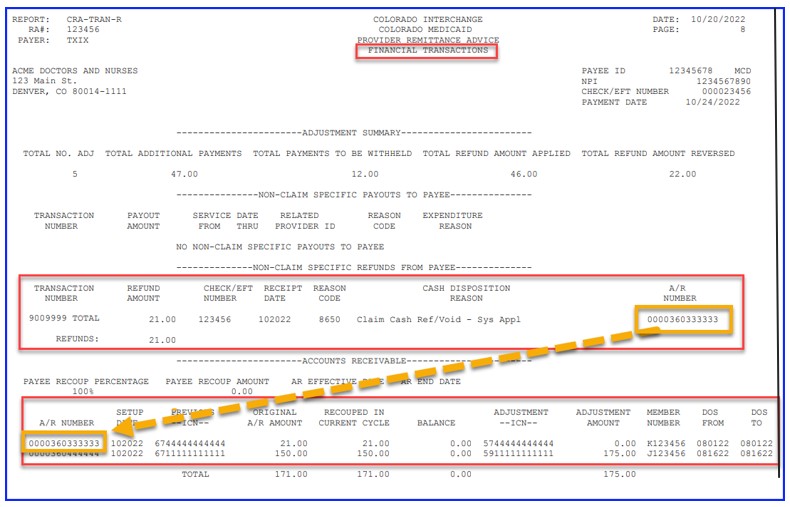

- A/R Number - A systematic number to identify Accounts Receivable. Additional information is in the Accounts Receivable section of the RA.

- Total Refunds

The Accounts Receivable (AR) section provides information on recoupments under Payee Recoup Percentage and Payee Recoup Amount fields and a list of all outstanding ARs. The AR may be partially recouped or not recouped at all which will be indicated by these two (2) fields. A recouping restriction is an established guideline in the Colorado interChange that limits or prevents the automatic recovery of all monies owed on an AR when there are available provider funds.

The only recouping restriction displayed on the RA is the Payee Max Recoup restriction, where the payee is the provider. This restriction is displayed in the following fields:

- Payee Recoup Percentage - The maximum percentage of a provider's payment that can be used to recover monies owed to Health First Colorado in that payment cycle.

or - Payee Recoup Amount - The flat, maximum amount to recover up to, but not exceeding the payment due to the provider.

The Payee Recoup Percentage, Payee Recoup Amount, AR Effective Date and AR End Date fields are specified if there is a Payee Max Recoup restriction in place for the provider.

The Payee Recoup Percentage field reads 100% if there is no Payee Max Recoup restriction in place, and all monies paid to the provider in that payment cycle may be used to recover monies owed to Health First Colorado.

Note: Any existing agreement between the provider and the Department regarding specific ARs owed will be honored regardless of these recouping restrictions.

Below the Payee Recoup fields, the following information is displayed for each outstanding AR. Fields are defined below and highlighted in Figure 2:

- A/R Number - The Accounts Receivable section includes Manual, Repayment and outstanding Automatic ARs without current cycle activity.

- Setup Date

- Previous ICN

- Original A/R Amount - The original accounts receivable setup amount.

- Recouped in Current Cycle

- Balance

- Adjustment ICN

- Adjustment Amount - The amount paid on the adjusted claim.

- Member Number - Member ID

- DOS From - The first date of service on the claim.

- DOS To - The last date of service on the claim.

See the Financial Transactions page in Figures 3 and 4 below.

Figure 3 . RA Financial Transactions

Figure 4 . RA Financial Transaction - AR Withholding

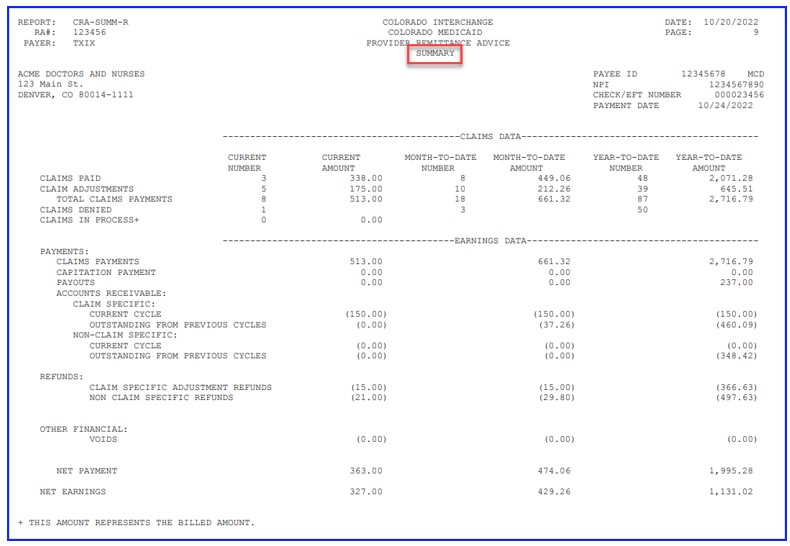

Summary Page

The RA Summary page provides claims data totals, information on payments to lien holders, earnings data totals and information on outstanding, expiring and expired paper checks.

The Summary page includes notifications that appear when a provider has received a payment for claims, refund, capitation agreement, etc. by paper check and that check is expiring or expired.

Notifications on the status of any uncashed paper checks are displayed on the RA under one of three categories:

- Outstanding Checks (checks within 90 days to six [6] weeks of expiration) - A notification appears on all RAs generated until the check moves to the next status (Expiring) or is cashed or voided.

- Expiring Checks (checks within six [6] weeks of expiration) - A notification appears on all RAs generated until the check is expired, cashed or voided.

- Expired Checks (checks beyond the 180 day "Void by" expiration date printed on the check and that are no longer eligible to be cashed by the bank.) - A notification appears once on the next RA generated for the provider.

See the example in Figure 5 below.

Figure 5. RA Summary

See the Financial Transactions and Summary page in Figure 6 below.

Figure 6. RA Financial Transactions and Summary

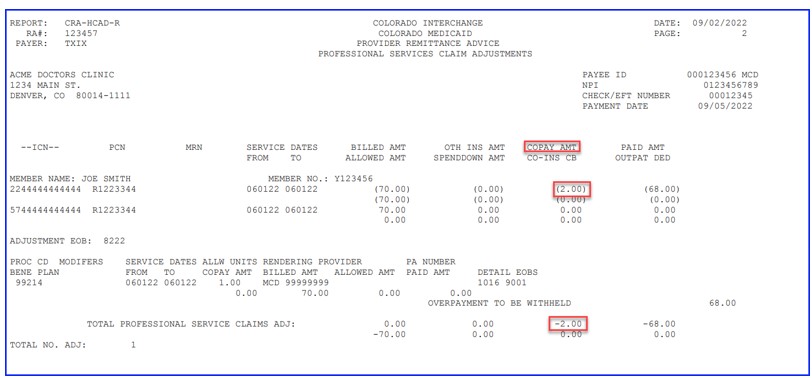

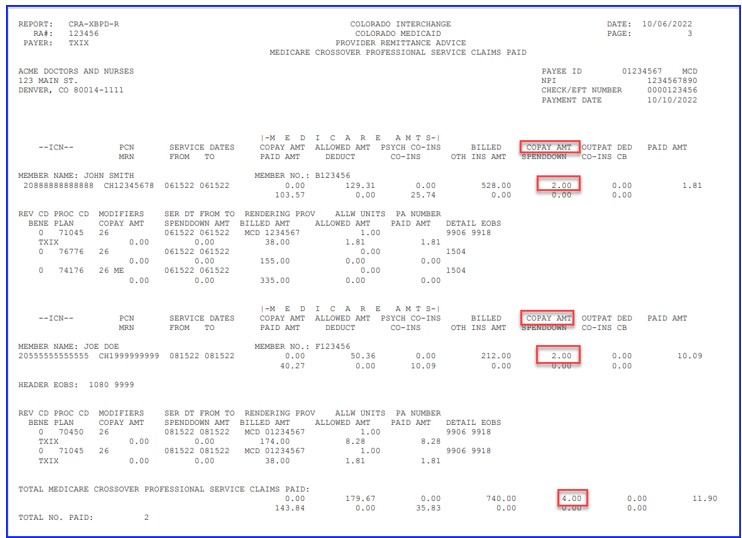

Recognizing Co-Pay

Co-pay represents the amount of member responsibility on a claim detail that is to be collected by the provider at the time the service is rendered.

Co-pay appears on the RA as COPAY AMT for the following RA types:

- Dental Claim Adjustments

- Dental Claims Paid

- Professional Service Claim Adjustments

- Professional Service Claims Paid

- Compound Drug Claim Adjustments

- Compound Drug Claims Paid

- Drug Claim Adjustments

- Drug Claims Paid

- Inpatient Claim Adjustments

- Inpatient Claims Paid

- Outpatient Claim Adjustments

- Outpatient Claims Paid

- Medicare Crossover Institutional Claim Adjustments

- Medicare Crossover Institutional Claims Denied

- Medicare Crossover Institutional Claims Paid

- Medicare Crossover Professional Service Claim Adjustments

- Medicare Crossover Professional Service Claims Paid

Figure 7. Professional Services Claims Adjustments

Co-pay appears on the RA as COPAY for the following RA types:

- Remittance Advice - Medicare Crossover Professional Service Claims

Figure 8. Remittance Advice - Medicare Crossover Professional Service Claims

Using a Comma-Separated Values (CSV) File

The Remittance Advice (RA) Comma-Separated Values (CSV) file, available for download through the Provider Web Portal Search Payment History panel, adds a line break between each record for clarity. Downloadable CSV-formatted RAs allow users the benefits of building a customized RA specific to their use and saving the file to their computer. The CSV file on a provider's Web Portal account appears as linear text separated by commas until it is downloaded into a compatible software program. Once downloaded, the file may be saved to a user's computer and the data manipulated.

To access the CSV file, providers should select the "Search Payment History" option from the left side of the provider's Web Portal home page. From the Search Payment History page, providers can search for a given payment. The RA CSV file is listed for each payment returned in the search. The provider can click on the icon under the RA Copy (Delimited) column to download the CSV file.

Note: Only the 10 most recent delimited RAs are available for download. All versions of PDF RAs are available for download.

To access the CSV file:

- Click Search Payment History on the left side of the Provider Web Portal home page.

- Search for a given payment. The RA CSV file is listed for each payment returned in the search.

- Click the icon under the RA Copy (Delimited) column to download the CSV file.

Formats include:

- Microsoft Office Excel

- Microsoft Office Access

- OpenOffice 2.2.1 -- free software program available

Free spreadsheet applications can be found at:

- Google Docs

- ZDNet

Need More Help?

Visit the Quick Guides web page to find all the Provider Web Portal Quick Guides.